NAVLIN Daily NewsCheckout Today’s News

NAVLIN Daily is on the ground at the World Evidence, Pricing and Access (EPA) Congress in Amsterdam this week, where speakers kicked off day one this morning with a series of keynote talksKeynote speakers unanimously acknowledged that in this era of uncertainty and “instability,” achieving sustainable patient access requires new, or augmented, ways of thinkingStay tuned as NAVLIN Daily covers EPA throughout this week, with reports direct from the conference as well as exclusive interviews with speakers

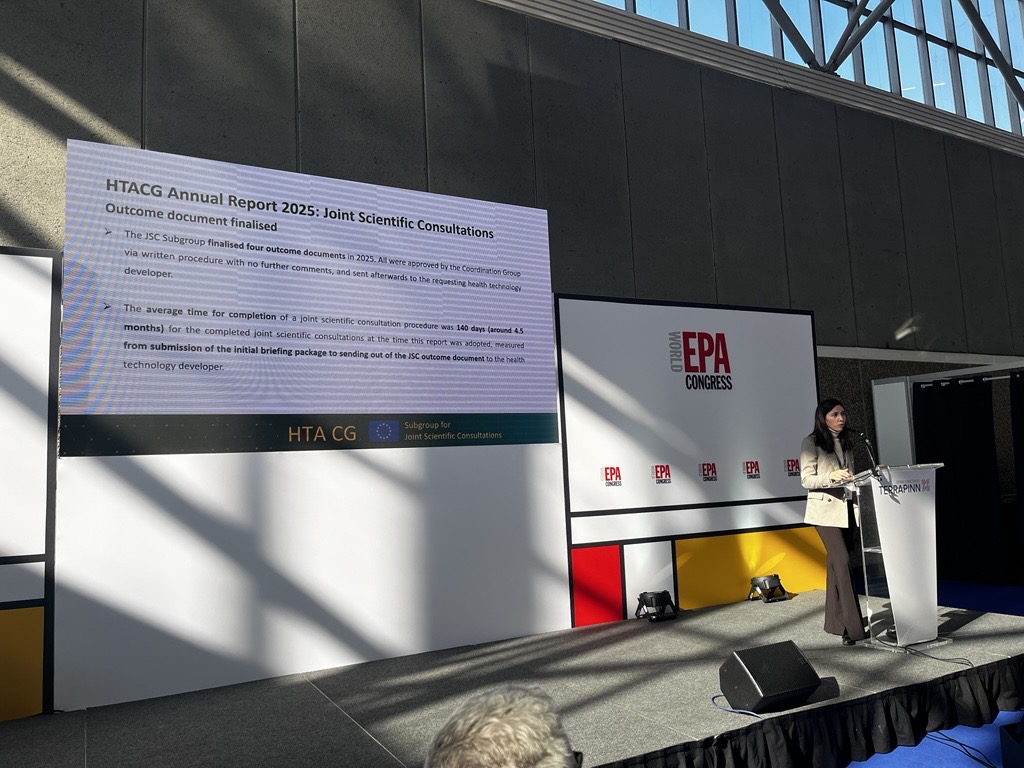

Speaking at the World Evidence, Pricing and Access (EPA) Congress in Amsterdam, Sonia Pulido Sánchez, Co-Chair of the Subgroup for Joint Scientific Consultations (JSC) of the HTACG, (and of AEMPS), spoke on the HTACG’s first year of JSC experienceShe confirmed findings from the recent HTACG annual report that developers consistently sought advice on patient population, comparators, outcomes, and study design, with frequent health economic queriesWhile Sánchez did not convey much more to the public than was already made available in the recent annual report, she did note that the organization is “trying to increase capacity gradually” due to high demand

During the week of February 23, 2026, several products won regulatory approvals and special designations across China, the U.S., and other markets Notable oncology approvals include Boehringer Ingelheim’s Hernexeos and also the FDA has approved AstraZeneca’s Calquence in combination with AbbVie and Genentech’s Venclexta NAVLIN Daily’s roundup of regulatory activity from the past week is below

Last week we started to see more early global impacts of U.S. MFN pricing, with Amgen withdrawing Repatha in Denmark and blaming pressure from the U.S.; the White House also signalled plans to strike more MFN deals from April 2026 Meanwhile, in a blow to Trump’s strategy, the Supreme Court struck down the Administration’s IEEPA-based tariffs Elsewhere, Korea's health authorities delayed approval for the contentious drug pricing reform to March, and Insmed paused the appraisal of Brinsupri (brensocatib) with the UK's National Institute for Health and Care Excellence (NICE) (until the QALY threshold changes, companies have the option to “pause” assessments)

U.S. President Donald Trump once again called on lawmakers to codify Most Favored Nation (MFN) drug pricing deals during his State of the Union address on TuesdayDrugmakers appear to be growing weary of the administration's attempts to push MFN beyond the voluntary deals announced so far. Following the speech, PhRMA President and CEO Stephen J. Ubl released a statement denouncing the policyThe industry organization also published the comments it submitted to CMS in response to the proposed GLOBE and GUARD models and appears to be readying a legal challenge against them

Significant changes could be coming to the U.S. pharmacy benefit manager (PBM) industry after new legislative and regulatory efforts, which include statutory changes, a proposed rule, and a precedent-setting legal settlementTogether, the measures look to bring transparency to the industry, reduce the net-to-list pricing spread, and could fundamentally change PBM business practices that have been the focus of the FTC and Congressional attentionNAVLIN Daily's Raechel Pusateri spoke to EVERSANA Management Consulting’s John Neal and Jim Burke, General Manager, Revenue Management, EVERSANA, to consider the major implications of the three actions, how other stakeholders might respond, and the most important changes manufacturers need to consider moving forward

UK ministers are under pressure after Trump imposed fresh tariffs up to 15%, as Lord Stockwood assures key sectors such as pharma remain unaffected thanks to the UK-U.S. trade deal announced last DecemberThe trade deal announced in December includes a 25% rise in NHS spending on new medicines, and a reduction in the rebate cap imposed on drugmakers under the current Voluntary Scheme for Branded Medicines Pricing, Access and Growth (VPAG). However, according to Polticio, U.S. officials are already looking beyond the current Voluntary Scheme for Branded Medicines Pricing, Access and Growth (VPAG), which runs until the end of 2028. People familiar with the talks told Politico that Washington wants a successor agreement negotiated before Trump leaves office in January 2029 and is pushing for a deal to be concluded by early 2028 to avoid U.S. election-year politicsMeanwhile, Lord Stockwood stated on Monday that "The Business Secretary spoke to U.S. trade representative Jamieson Greer this weekend, making clear our concerns about uncertainty and our degree of confidence in the honouring of those agreements that we needed, and he had those reassurances. UK officials across Whitehall and Washington are engaging intensively with the U.S. as we speak, and those discussions will continue all of this week, at which time we can update the House"

During the week of February 23, 2026, several companies announced new partnerships and M&A activityDeals include several new licensing and commercialization agreements in China and Canada, as well as a research and licensing deal between Novartis and Unnatural Products to develop next-generation cardiovascular therapies using UNP’s AI-driven platformNAVLIN Daily’s roundup of industry deals and agreements from the past week is below

Last week saw the release of the first HTACG report, detailing the findings from the first year of JCAs in Europe Ex-U.S. markets are still investigating how global developments, particularly in the U.S., could affect drug pricing; Sweden’s Dental and Pharmaceutical Benefits Agency (TLV) has been tasked with analysing companies’ willingness to launch in Sweden under new rules Finally, HTA agencies in Europe were busy! HAS backed AstraZeneca’s Imfinzi (durvalumab), as well as granting post-MA early access scheme to Daiichi Sankyo’s Enhertu (trastuzumab deruxtecan), while NICE recommended GSK’s Zejula (niraparib). In the Netherlands, ZIN rejected Leqembi, following in the footsteps of Denmark and France

A senior health official in the Trump administration revealed at the recent ACCESS Forum U.S. conference that the White House expects to engage in additional voluntary MFN deals with manufacturers starting April 2026The official also discussed several aspects of the Trump administration’s approach to MFN, including strategies for obtaining net price informationThe keynote focused on aspects of the voluntary deals and the GENEROUS model, which applies to Medicaid, and offered few details on GLOBE and GUARD, which are mandatory and apply to Medicare Part B and D, respectively