NAVLIN Daily NewsCheckout Today’s News

China is rolling out the first eight batches of its centralized procurement round, with contracts active until 2028. Procurement officials are calculating basic quantities, while remaining quantities are allocated by medical institutions to additional suppliers offering prices equal to or below the quotation benchmarksOver 51,000 medical institutions participated in the last procurement round, with 1,091 companies bidding for 4,623 products. The process favored oral solid drugs over injectables and saw strong competition in oncology and chronic disease areas, while specialty drugs drew fewer biddersBig players like Qilu Pharmaceutical excelled, maintaining a win rate above 95%, but hundreds of smaller firms secured just one product. Ambroxol injection led in popularity with 48 suppliers winning bids. Leading manufacturers are likely to grab a larger market share as they ensure stability in supply

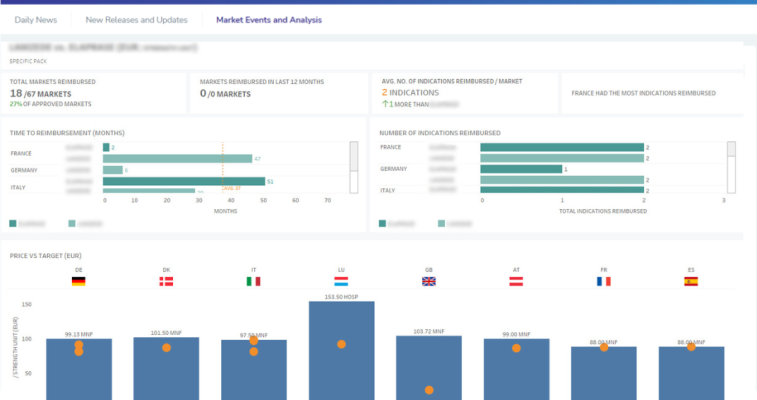

Speaking at the World Evidence, Pricing and Access (EPA) Congress in Amsterdam, Sandro Cesaro, Head of Europe Market Access & Pricing at AstraZeneca, encouraged companies to “Act locally, think globally” when launching in the “new world order”While acknowledging that the EU pharma legislation has “a good objective,” Cesaro cautioned that policymakers must avoid introducing conditions that inadvertently undermine incentives for innovationHe warned that the emergence of MFN-type policies could accelerate the trend toward global price interconnectivity, particularly with the proposed net price transparency initiatives that Trump is planning

Nordic HTA bodies, which already collaborate extensively, are preparing to integrate Joint Clinical Assessment (JCA) reports into their Nordic-level and national-level assessmentsAt EPA, Maria Eriksson, medical assessor at Sweden's Dental and Pharmaceutical Benefits Agency (TLV), said that Nordic authorities believe they are well prepared for the transition, owing to their longstanding involvement in European HTA cooperation; particularly as several JNHB members were involved in EUnetHTA, and the Nordic countries have already taken on assessor and co-assessor roles in the first wave of JCAsEriksson sees positive outcomes for the Nordics from JCA, including faster timelines (as fast as 90 days), shared resources across countries, aligned processes, and better rare disease assessments. Additionally, early visibility of PICOs will help them identify appropriate products for the region and proactively engage with manufacturers

Speaking at the World Evidence, Pricing and Access (EPA) Congress, Neil Grubert offered delegates a high-level whistlestop tour of global policy changes, akin to his concise and informative LinkedIn presence He acknowledged that the implications of such widespread changes are still unclear. “Europe may offer greater stability,” he suggested, “but the pace of policymaking is slower compared with the increasingly rapid, and volatile, regulatory environment in the U.S.”Interestingly, he argued that China’s accelerating innovation capacity is being overlooked, and that it may actually have the most impactful long-term effects of all global changes

A panel at the World Evidence, Pricing and Access (EPA) agreed that under Most Favored Nation (MFN), “Launch or no launch [in ex-U.S. markets] becomes a binary decision. If there’s no launch, everybody loses, patients, the healthcare system and the company.”Dierk Neugebauer, VP for market access and government affairs at Bristol Myers Squibb, suggested that markets left unserved by multinational companies could create opportunities for other manufacturers. “China is waiting for something like this,” he said. “If companies decide not to launch in certain markets, others may step into that gap”On top of this, Alan Crowther, general manager at EVERSANA, argued that global pricing is increasingly becoming a “zero-sum game,” while Ulrik Haagen Panton, VP global pricing at Novo Nordisk, suggested “Net price referencing is potentially a dealbreaker" for existing confidential mechanisms

If day one established the themes of disruption and uncertainty, day two reinforced that Most Favored Nation (MFN) is now the single most disruptive force in global market access.. perhaps everSessions across the tracks and auditorium returned repeatedly to the same issue: how companies should navigate an increasingly interconnected (and increasingly volatile) global policy environmentHere are NAVLIN Daily’s key takeaways from day two

The general consensus this year at the World Evidence, Pricing and Access (EPA) Congress was that we are in an era of “policy-driven pricing” unlike anything seen before, as the United States’ Most Favored Nation (MFN) policy reaches its tendrils into global marketsOn day two of the Congress, Alan Crowther and Dr. Richard Wenzel of EVERSANA argued that the industry must already be rethinking its traditional launch sequence in a world where international prices can directly affect U.S. revenues, a market that historically accounted for a large share of companies’ revenues“Much like when the toothpaste comes out of the tube, you can’t get it back in,” Crowther said, referring to the spread of MFN. “It’s not just that the U.S. is doing this. Other markets will look at it and say: Why not us too?”

NAVLIN Daily is on the ground at the World Evidence, Pricing and Access (EPA) Congress in AmsterdamDay one set the tone for a conference defined by an unstable global policy landscape, and conversations revolved around the unavoidable: Most Favored Nation (MFN) pricing, Joint Clinical Assessments (JCA), Joint Scientific Consultations (JSC) and artificial intelligence (AI)Click through to the article for the key takeaways from the presentations and panels of day one

Day two of the World Evidence, Pricing and Access (EPA) Congress opened with a clear message from industry and health economists: governments should treat health spending as an investment in prosperity, not an expenseSpeakers argued that building the “macroeconomic business case” for medicines requires quantifying not only the sector’s economic footprint, but also the productivity and “cost of inaction” effects of ill-health, particularly as demographics shift to ageing populationsThe following keynotes on AI suggested adoption is accelerating across market access (contrary to what we heard yesterday), but governance, traceability and organisational change remain as barriers. Read our coverage of EPA 2026 here

NAVLIN Daily is on the ground at the World Evidence, Pricing and Access (EPA) Congress in Amsterdam this week, where speakers kicked off day one this morning with a series of keynote talksKeynote speakers unanimously acknowledged that in this era of uncertainty and “instability,” achieving sustainable patient access requires new, or augmented, ways of thinkingStay tuned as NAVLIN Daily covers EPA throughout this week, with reports direct from the conference as well as exclusive interviews with speakers